per capita tax burden by state

The five states with the highest tax collections per capita are New York 9073 Connecticut 7638 New Jersey 6978 North Dakota 6665 and Hawaii 6640. States with largest tax burdens New York Unsurprisingly New York has the largest state tax burden.

State Tax Maps How Does Your State Rank Tax Foundation

However Alaska Florida Nevada South Dakota Tennessee Texas and.

. Some states have higher tax burdens than others due to their government spending more per capita on public programs or because of high income taxes for wealthier residents. Our ranking of Best And Worst States for Taxes captures the total tax burden per capitanot only for income property and sales tax but. Sales and gross receipt taxes.

The effective tax burdens in these states are 125 122 and 116. Delaware follows with 552 and the second-lowest sales and excise tax rate of 120. Finally New York Illinois and Connecticut are the states with the highest tax burden for the middle 60 by family income.

Total taxes per capita. 47 rows Table 2. The state with the lowest tax burden is Alaska at 516.

State and local tax. Individual income tax burden. On the other end of the spectrum Alaska 58 percent Wyoming 70 percent and Tennessee 70 percent had the lowest burdens.

Income tax collections per capita. When breaking down tax burdens by category New Hampshire has the highest property tax burden in the nation at 557. 0 tied - the lowest Property tax collections per capita.

Connecticut 128 percent and Hawaii 127 percent followed. Redirecting to state-rankingstax-burden-by-state 308. 211 rows Total taxes thousands Population Per capita State Alabama.

For most states in the United States the primary means by which state governments take money from their residents is through income taxes. Income tax collections per capita. Federal Receipts.

1498 25th lowest General sales tax. States with the lowest individual income tax rates are Indiana 323 Pennsylvania 307 and Indiana 323. State-Local Tax Burdens by State with Detailed Breakdown Calendar Year 2022.

Chart 2 portrays the change in per capita state and local taxes since 1970 for Washington and the average for all states. A per capita tax comparison is far from complete however because differences in the level of. For example a taxpayer who earns 50000 and pays 5000 to his state and federal governments has a tax burden of 10 percent.

Alaska is one of seven states with no state income tax. State and local governments have complete. Total sales and excise tax burden.

Residents pay 44 in property taxes. State and Local Tax Revenue Per Capita. The jurisdictions with the lowest overall tax rate by state for the top earners are Nevada 19 Florida 23 and Alaska 25.

State and local tax burdens of about 115 per 1000 of personal income were typical for Washington and the state usually. Download dqs_table_79apdf 13371 KB Download dqs_table_79axls 445 KB August 26 2021. Property tax burden.

New Yorkers faced the highest burden with 141 percent of income in the state going to state and local taxes. We share the overall tax burden by state for an average household to help decide where to.

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Legal Marketing Local Marketing Business Tax

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Per Capita U S State And Local Tax Revenue 1977 2019 Statista

Average Tax Return In Usa By State And Federal Revenue From Income Taxes Per Capita In Each State Infographic Tax Refund Tax Return Income Tax

Per Capita U S State And Local Tax Revenue 1977 2019 Statista

State Gasoline Tax Rates By The Tax Foundation Safest Places To Travel Infographic Map Safe Cities

These States Have The Highest And Lowest Tax Burdens

Monday Map Sales Tax Holidays In 2013 Back To School Shopping American History Timeline Back To School

Tax Burden By State 2022 State And Local Taxes Tax Foundation

State By State Guide To Taxes On Retirees Retirement Retirement Income Retirement Planning

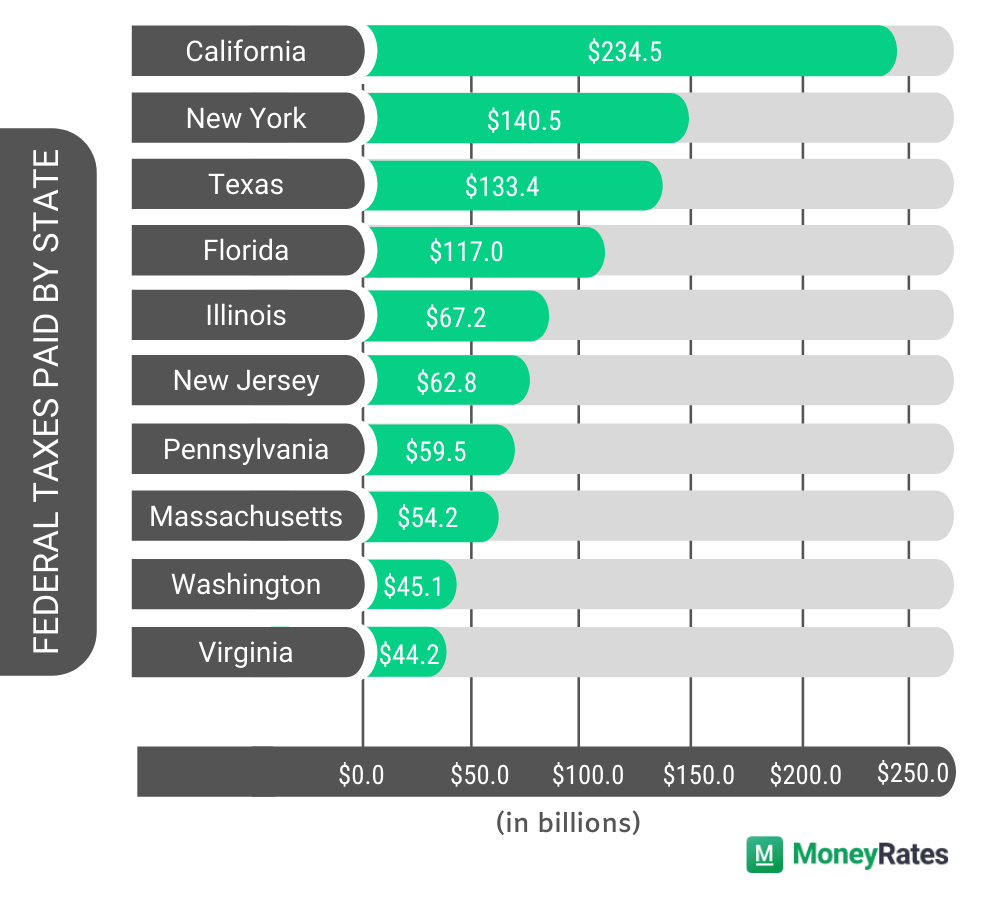

Which States Pay The Most Federal Taxes Moneyrates

2016 Property Taxes Per Capita State And Local Property Tax Buying A New Home Home Buying

Best States To Retired In With The Lowest Cost Of Living Finance 101 Gas Tax Healthcare Costs Better Healthcare

Mapsontheweb Infographic Map Map Sales Tax

States With The Highest And Lowest Property Taxes Property Tax Tax States

Compare Sales Income And Property Taxes By State Us Map 2011 Property Tax Map Us Map

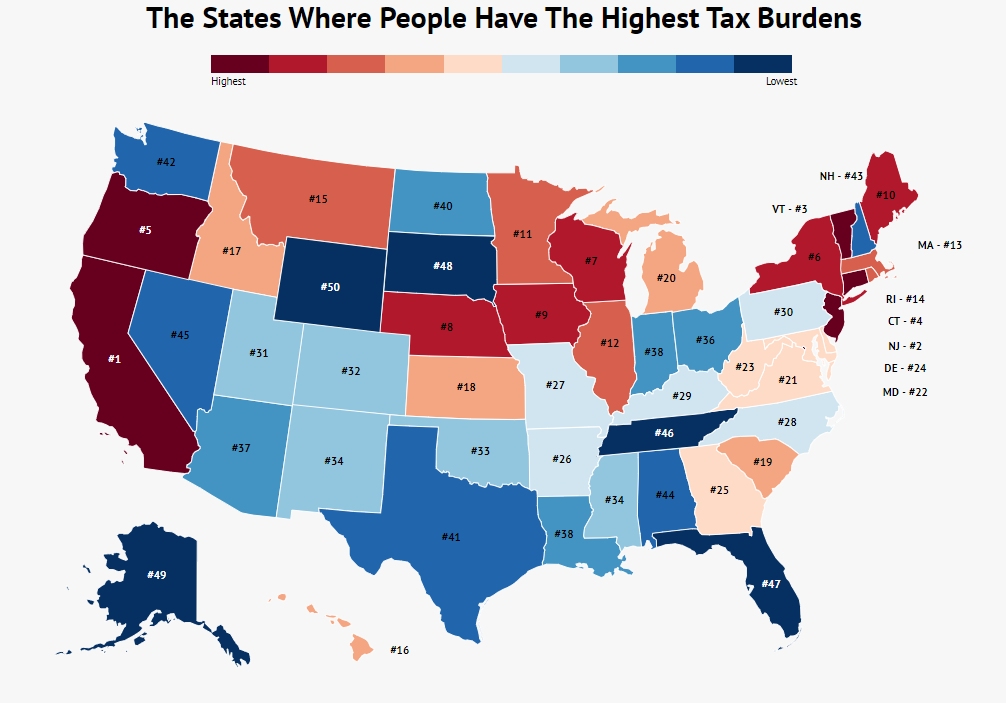

The States Where People Are Burdened With The Highest Taxes Zippia